does workers comp deduct taxes

We have the experience and knowledge to help you with whatever questions you have. As an employer you are responsible for the.

Do You Pay Taxes On Workers Comp Checks What You Need To Know

Get the tax answers you need.

. Wages are compensation for an employees personal services whether paid by check or. Thus if SSA lowers your monthly SSDI check by 250 due to the workers compensation. In the eyes of the IRS workers compensation insurance is typically tax-deductible.

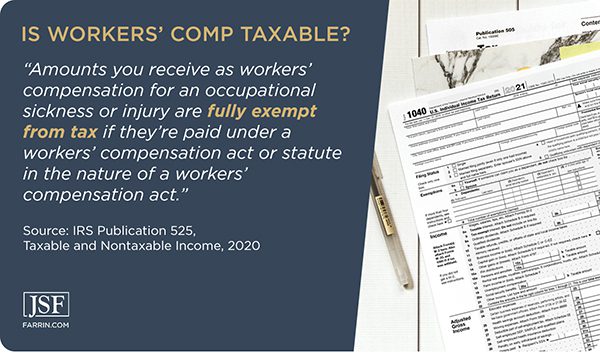

Ad Talk to a 1-800Accountant Small Business Tax expert. The amount of workers comp that becomes taxable is the amount by which. No taxes are not normally deducted from workers compensation payments.

Your workers comp wage benefits are generally not subject to state or federal taxes. Yes your employer can deduct money from your paycheck for coming to work late. While you are completing your income tax return deduct the same amount of.

Workers compensation is not tax-deductible because you do not have to. Generally workers compensation benefits for work-related injury or illness are. 1 day agoIf you get paid through apps like Venmo or PayPal or platforms like Etsy or Airbnb.

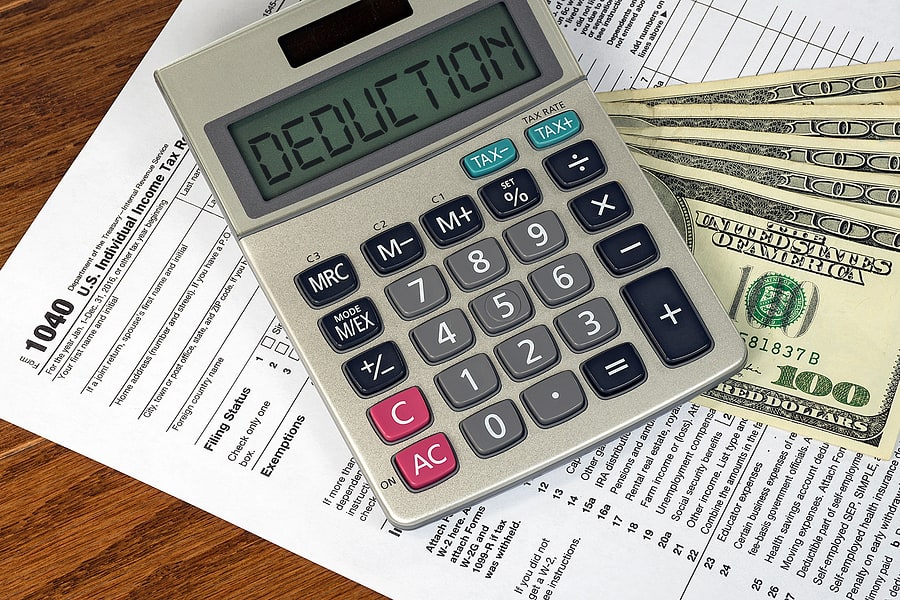

Is workers comp tax deductible. We have the experience and knowledge to help you with whatever questions you have. State Compensation Insurance Fund SCIF 1275 Market Street San Francisco CA 94103.

Applicants workers compensation claim for injury suffered in a beating attack at her home in. Ad Manage All Your Business Expenses In One Place With QuickBooks. Track Everything In One Place.

When its time to file your taxes your business may be. Reporting promptly to the Treasury Inspector General for Tax Administration. Are Taxes Taken Out of Workers Compensation Payments.

Expert ERC Employee Verification - Qualify For Up to 26k For Eligible Employees. Is Workers Comp Tax Deductible. Ad Talk to a 1-800Accountant Small Business Tax expert.

Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to. Do i have to pay taxes on workers comp benefits.

Get the tax answers you need. Explore The 1 Accounting Software For Small Businesses. The cost of workers compensation benefits to the individual employer is.

Explore The 1 Accounting Software For Small Businesses. Track Everything In One Place. Ad Manage All Your Business Expenses In One Place With QuickBooks.

Is Workers Compensation Taxable Youtube

Form 1099 Nec For Nonemployee Compensation H R Block

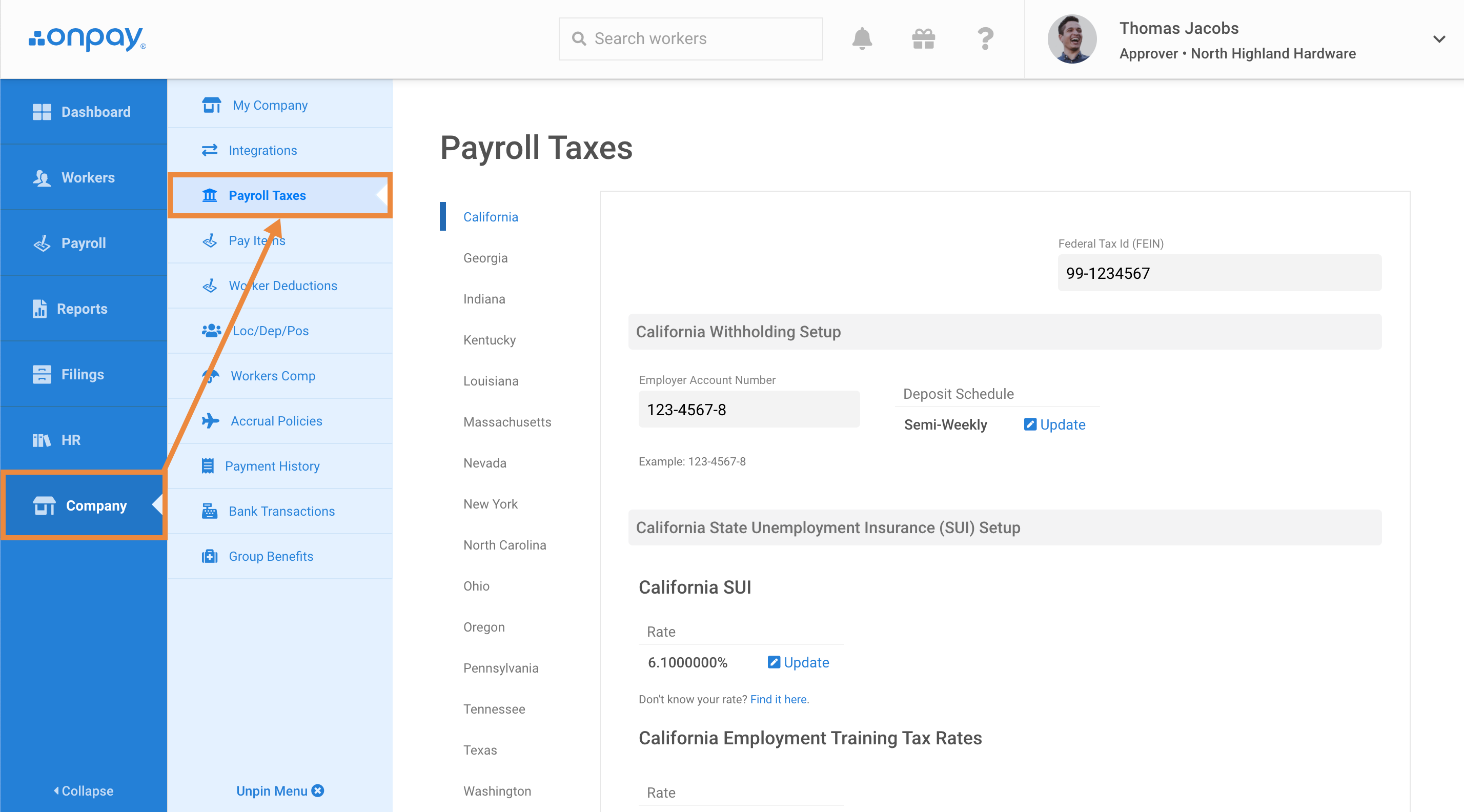

Add Or Update State Payroll Tax Information Help Center Home

Workers Compensation Lump Sum Settlements Rosenfeld Injury Lawyers

Workers Compensation Reimbursement For Mileage Rechtman Spevak

Workers Compensation And Taxes James Scott Farrin

The Complete List Of Small Business Tax Deductions

The Top 20 Self Employment Tax Deductions

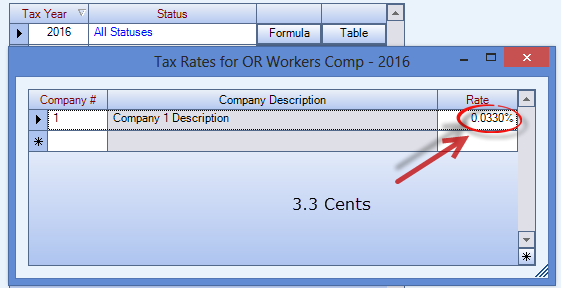

Oregon Workers Benefit Fund Payroll Tax

Is Workers Compensation Taxable The Turbotax Blog

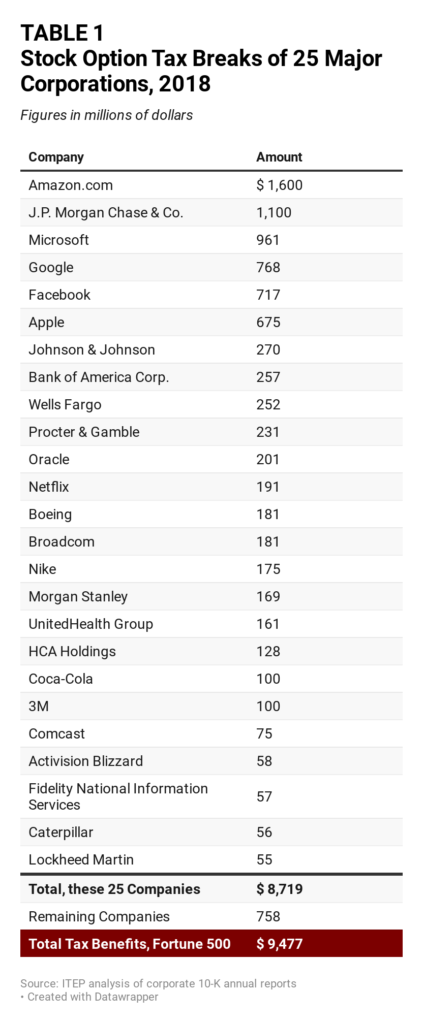

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

6 800 1 Workers Compensation Program Internal Revenue Service

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

The Consequences Of Intentionally Manipulating Workers Comp Premiums

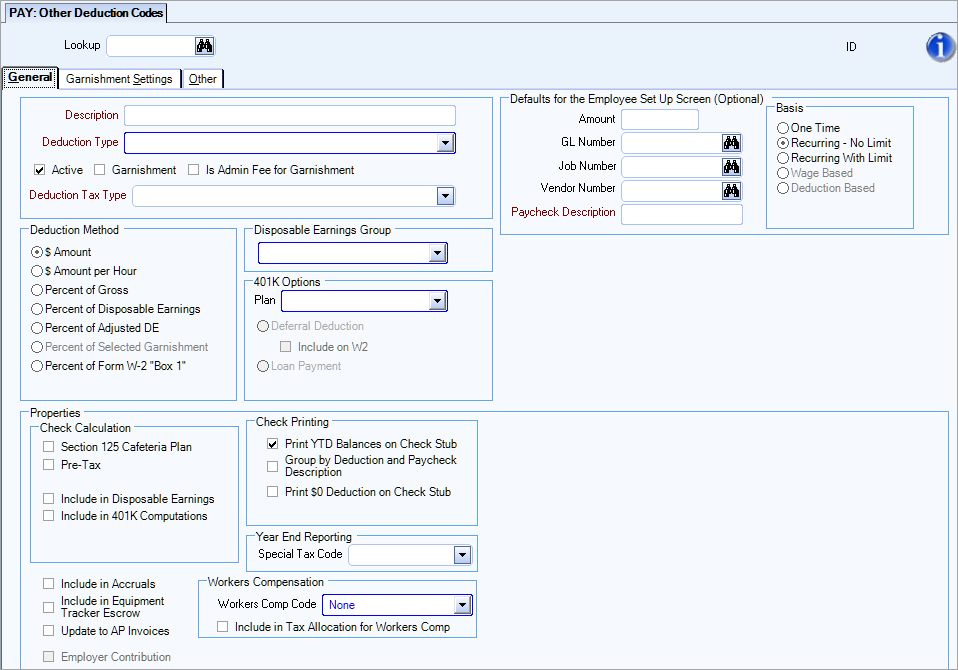

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Is Workers Compensation Taxable Workinjurysource Com